All Categories

Featured

State Ranch representatives offer whatever from homeowners to car, life, and various other prominent insurance policy products. State Farm supplies universal, survivorship, and joint universal life insurance policy policies - best variable life insurance.

State Ranch life insurance policy is usually conservative, providing stable alternatives for the average American household. If you're looking for the wealth-building chances of universal life, State Ranch does not have affordable options.

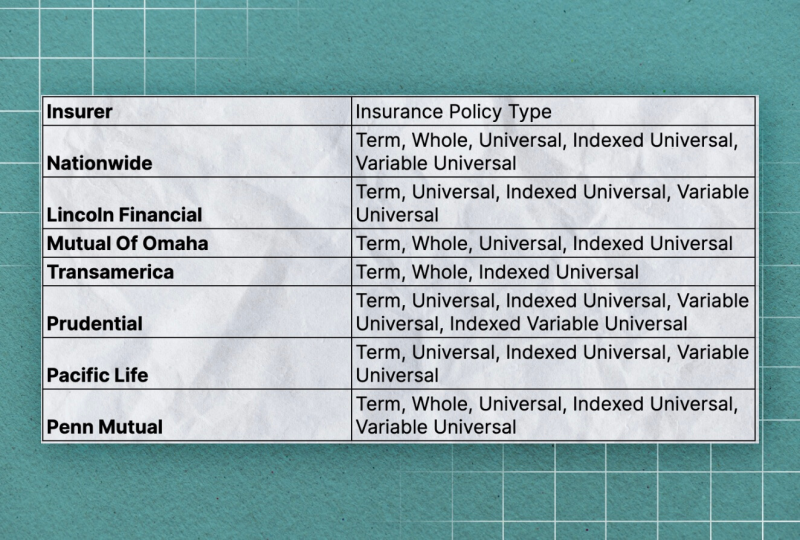

It doesn't have a strong visibility in various other economic items (like global strategies that open the door for wealth-building). Still, Nationwide life insurance policy strategies are extremely available to American households. The application procedure can likewise be much more manageable. It aids interested celebrations obtain their first step with a dependable life insurance policy plan without the a lot more difficult conversations regarding investments, financial indices, and so on.

Nationwide fills up the important duty of obtaining hesitant buyers in the door. Even if the worst occurs and you can't get a bigger plan, having the security of an Across the country life insurance policy plan can transform a purchaser's end-of-life experience. Review our Nationwide Life insurance policy review. Insurer make use of clinical exams to evaluate your danger class when applying for life insurance policy.

Customers have the alternative to transform rates each month based on life scenarios. A MassMutual life insurance coverage representative or financial advisor can help buyers make plans with area for modifications to fulfill short-term and long-lasting monetary goals.

Universal Guaranteed Life Insurance

Some purchasers might be shocked that it offers its life insurance coverage policies to the general public. Still, military members enjoy special benefits. Your USAA policy comes with a Life Event Choice cyclist.

VULs come with the greatest risk and the most potential gains. If your policy doesn't have a no-lapse guarantee, you might even lose coverage if your cash money value dips below a particular limit. With so much riding on your financial investments, VULs call for consistent interest and maintenance. It might not be a terrific choice for people who just want a fatality benefit.

There's a handful of metrics by which you can judge an insurance coverage firm. The J.D. Power client satisfaction ranking is an excellent choice if you desire a concept of just how clients like their insurance coverage plan. AM Finest's financial toughness ranking is an additional important metric to think about when picking an universal life insurance policy firm.

This is especially vital, as your cash money value grows based on the financial investment alternatives that an insurance provider provides. You need to see what investment options your insurance coverage company offers and compare it versus the goals you have for your plan. The most effective way to discover life insurance coverage is to gather quotes from as numerous life insurance policy companies as you can to comprehend what you'll pay with each policy.

Latest Posts

Is Indexed Life Insurance A Good Investment

Life Insurance Cost Indexes

Best Iul Companies